Bull Markets This refers to the financial market of a group of traded securities’ prices are rising or expected to rise for extended periods. Securities, especially equities also held in mutual funds and ETFs, can benefit from a bull market for months or even years. Yet they are difficult to predict. Looking over the years, they occur when stock market valuations rise by 20%, usually after a drop of 20%.

Signs of a Bull Market

- the economy is strengthening or is already strong

- strong gross domestic product (GDP)

- less unemployment

- investors eager to invest by buying securities held also in mutual funds

- positive demand for equity investments increase

Bulls versus Bear Markets These animal terms metaphorically define the movement of a market. If the trend is aggressively up, it’s a bull market. If trending down, it’s a bear market. Both looming markets may be only hinted at before an economic cycle takes hold.

Note: If you have any questions regarding investments, please contact me.

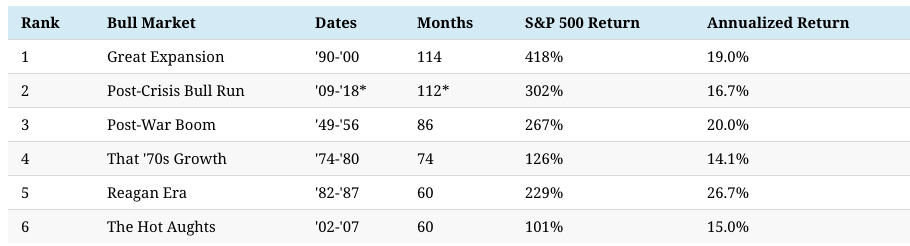

Taking Advantage of a Bull Market Investors who want to benefit from a bull market may take advantage of rising prices – though it’s hard to predict when a market will peak. These graphics indicate the past bull markets: