Mindfulness guides our best financial decisions. Dr Ellen J. Langer is the author of the classic book Mindfulness which details years of study of behaviour related to mindful thinking versus unmindful paradigms that form our reality. How we invest for retirement or why we habitually take on debt, has a lot to do with our dominating attitude about money. William James said, “a human being can alter his life by altering his attitude.” It is as easy to form a good habit of successful investing with a purpose, as it is to succumb to the unmindful habit of accumulating debt. It depends on our mindfulness—our ongoing awareness before we invest or take on more debt.

What you can and can’t control:

- You can’t control the length of your retirement life—but if mindful, you can control your decision to invest for income.

- You can’t control investment performance all the time—but if mindful, you can begin the process of aiming at investing for financial success.

- You can’t control life’s changes—but if mindful, you can control your ongoing commitment and process of building up your RRSP and/or TFSA investments.

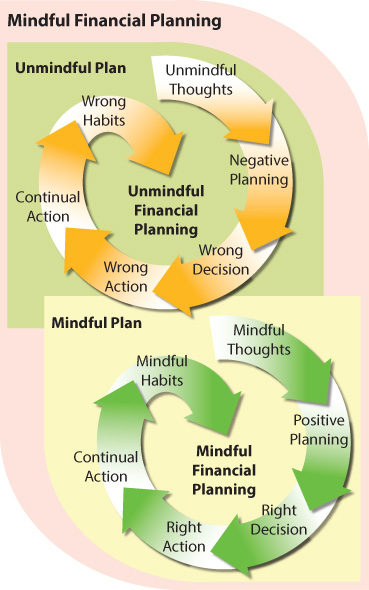

Look at the two cycles and see the value of mindfulness.

The graphic indicates how our early ideas about financial planning may affect your future financial planning, decisions, and action plans. We have to become aware if we are or are not mindful which can depend on our upbringing or our early monetary values that were established to guide our life decision processes.

The principle of mindful investing Is financial success a destination or a journey? If you hold to a destination mindset you may not begin the process of investing for fear that you may fail at what may seem like a daunting task of accumulating enough capital necessary to live on, over a long period of time. Financial success is not a destination, it is a process—a life journey measured by life’s milestones. I quote from the book Mindfulness: “From kindergarten on, the focus of schooling is usually on goals rather than on the process by which they are achieved. This single-minded pursuit of one outcome or another, from tying shoelaces to getting into Harvard, makes it difficult to have a mindful attitude about life”. Ellen J. Langer, 2014, Mindfulness, Da Capo Press, Boston, pg. 35

You gain confidence, by being mindful that a financial plan is a step by step living process far beyond a goal with a timeline with big end-game numbers. There are very important rules that mindful investors can apply, especially when young. Learning early in life when you are in your 20s or 30s, the value of time for investing makes perfect sense. If you are 55 in a low-interest environment, you will need to be very mindful of every decision that you make involving money to meet your retirement income needs.

“We know that the first step towards the intellectual mastery of the world in which we live is the discovery of general principles, rules and laws which bring order into chaos. By such mental operations, we simplify the world.” Sigmund Freud

The principle of mindful debt reduction Debts plus interest eventually have to be repaid subtracting from our retirement income! “Curious how often you Humans manage to obtain that which you do not want.” (Errand of Mercy,” (Star Trek, Spock)

What is HELOC debt? This debt is associated with your Home Equity Line of Credit (HELOC). Consumers are shifting unsecured high-interest credit card balances to a lower interest HELOC arrangement of debt. Be mindful that this growing shift to HELOC debt helps the balance sheets of the lenders because this debt, once transferred, becomes secured collateral with everyone’s real estate. Think seriously about reducing your debt portfolio especially if you hold a lot of HELOC debt. Many people are inadvertently reducing their home equity in the process of securing a once unsecured credit card, while hinging on reducing their home value.

Becoming mindful during the financial planning cycle Often, the financial rules and laws that we learned were from following the wrong advice, or due to lax guidance in our youth which can later lead to falsified views that determine our financial destiny.

“Mindfulness can help you achieve the necessary clarity, focus, and peace of mind. These principles are especially applicable to the world of finance and investing, where stakes are high, sound decision making crucial, and many variables exist outside of our control.” The Mindful Investor (Maria Gonzalez and Graham Byron)

Mindful financial planning can change our views on debt and the need to invest with clarity of purpose, calmly without fear. It is important that we begin investing and become mindful of debt which can lessen our potential for a good retirement.

Sources: Adviceon | Statistics Canada | Bank of Canada